Why the Future of Value Creation Is Physical

May 20, 2025

Real problems, like feeding people and affecting the climate trajectory, exist in the real, physical world. Solving them requires real, physical intervention. Ultimately, solving human-centric problems is the fundamental basis of creating value.

There are many “problems to solve” in Agriculture – growers must harness the power of nature and simultaneously battle it season after season. Agricultural technology has, for many years, had a clear potential to address a myriad of challenges growers encounter regularly. However, it seems that Agtech specifically is struggling to actually create value.

The team at Double Yolk has been fortunate enough to work with dozens of startups, technologies, and investors across the Agtech space for more than 5 years - we’re sharing our unique viewpoint of the industry and how we might adjust things to more effectively implement technologies and support those who grow the food we survive on.

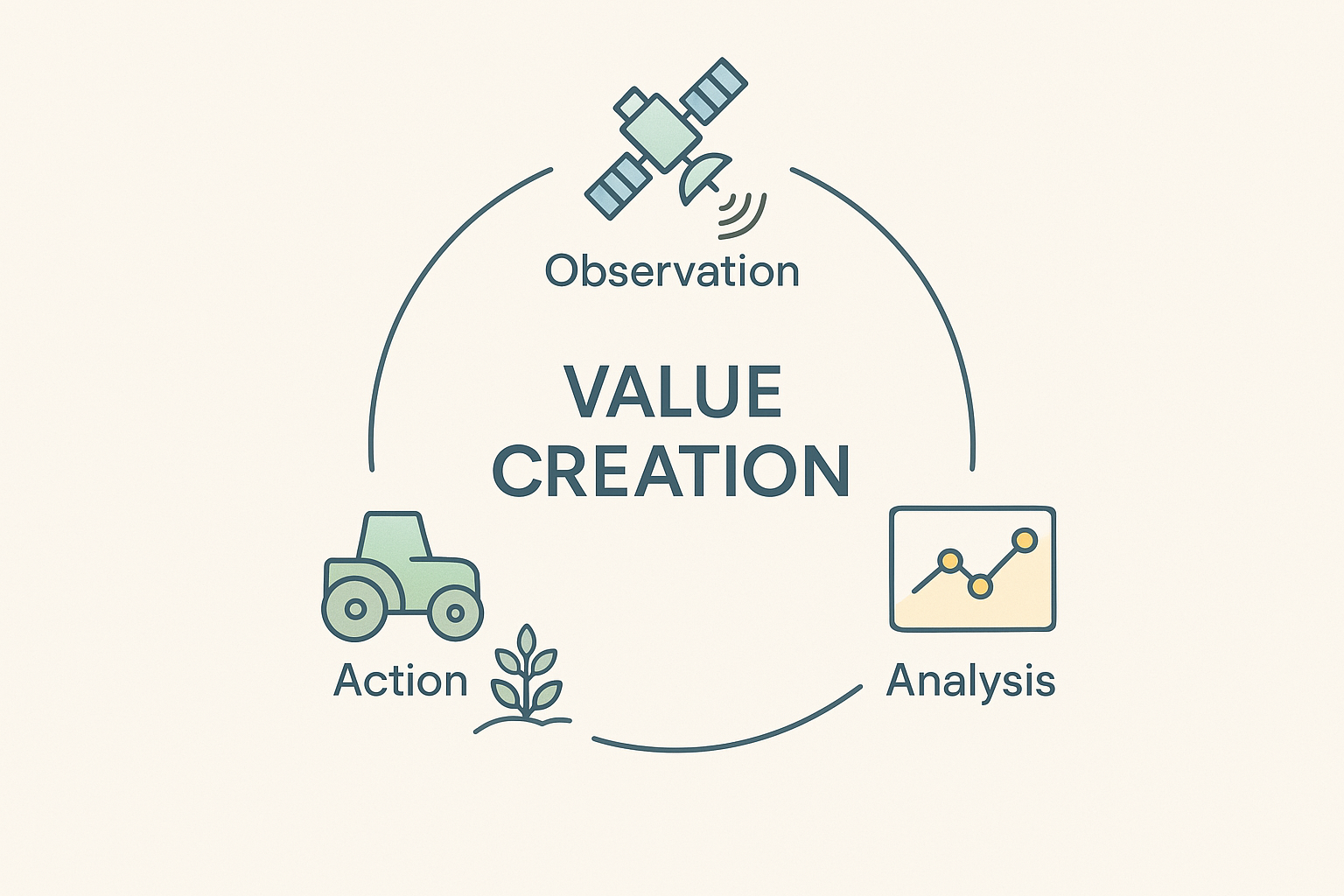

The Ag Value Loop: Observation → Analysis → Action

There’s a cycle at the core of value creation in Agriculture. This loop has been operating for thousands of years and has 3 phases:

- Phase 1: Observation

A physical interaction that reveals information about the current state of the system. A human walks the fields and notes what they observe. A sensor in the soil provides moisture readings. A multispectral image from a satellite measures plant health. - Phase 2: Analysis

An analytical process comparing the current state to that of some ideal target state. Understanding the delta and building a path between where things are and where they should be. These fields are water stressed and need additional irrigation. Block B4 is diseased and needs treatment. - Phase 3: Action

The physical interaction that advances the current state toward the ideal target state. The field gets sprayed, irrigated, amended by a human, a machine, or more likely, a human working with a machine. The crop yield/quality increases and/or inputs decrease.

And repeat. It seems trivial, but by simplifying the value chain in this way it’s easier to see:

- The value is created once just once – at the moment the change actually happens in the field during the “Action” phase. When the fertilizer gets applied. When the water gets delivered. When the pest gets treated. That’s when the grower sees a real change in their top or bottom line. From that point, value “flows” backwards, justifying the analysis, validating the observation. But without action, there is no value.

- Value creation is bottlenecked by the resolution and economics of the Action Phase. A grower might have 1m soil nutrient precision from phases 1 or 2 – but if their spreader operates at 20m fixed rate, 20m is the limit. Similarly, having precise data on when fruit is ripe and ready to pick is meaningless if the grower lacks the labor to do the picking. Value is not capped not by what’s known – but by what can be done.

Most Agtech companies operate in one or two of these phases. It’s important to understand which phases a given technology advances or is a customer of – and whether it recognizes the others. Where & how it hands off to humans, what they are expected to do (and crucially, what they’ll need to do above and beyond what they are doing now) and how it fits with the rest of the ecosystem are important questions for startups and investors to answer. The lack of visibility ecosystem- wide has created a foundational issue that manifests itself in some of the challenges we perceive in Agtech today.

The Triple Claim Problem

There’s a habit of attributing 100% of the total value creation to a single company/technology in any given phase.

The sensor company says, “Growers now know exactly what’s happening in their fields, saving them 20% on inputs because they can adjust their usage”

The farm management platform comes in and says, “we’ve optimized the treatment plan – we show exactly when, where, and how to apply, reducing grower inputs by 20%.”

The precision sprayer company says, “we’re delivering 20% savings by only spraying where it’s needed.”

In reality, it takes all three layers – observation, analysis, and action – to get the outcome. But each company makes decisions like it’s responsible for the whole thing (or that humans will automatically fill in the remaining gaps at zero cost).

Each company builds its pricing, financial model, and ultimately its valuation like it's 100% responsible for the value creation. But the grower only sees that they saved $20 an acre, So now you’ve got three companies all pointing to that same $20/acre and saying, “that was us.” And that is where the distortion begins.

That’s how we end up with startups that look like they’re working—until they run out of runway. Not necessarily because the tech didn’t function, but because the economics were built on a false sense of ownership over value that was actually created by a group of people/technologies.

The grower sees this too, by the way. These aren’t just backend problems. This misalignment shows up in the promises being made. The marketing says, “save 20%.” But the grower tries to implement it and ends up doing more work, requiring more tools, for a smaller payoff than expected. And it’s because the value was over-allocated across all these different technologies that depend on each other, but don’t share the credit – or account for the costs. Resetting the expectations around AgTech would be beneficial in this, and other, regards.

Expectations vs. Reality

There’s a persistent narrative that venture capital just doesn’t work in Agtech. That the cycles are too long, adoption too slow, and exits too rare. But that framing misses the point. It’s not that VC and ag are incompatible – it’s that we’ve been modeling value in a way that’s disconnected from how value actually gets created in the field.

Yes, overstated value claims are part of the issue –the triple-claim problem distorts who’s doing what, and how much it’s worth. But there’s a deeper disconnect too: many Agtech companies build ROI models that only work inside a tightly controlled sandbox. Everything adds up—until you step outside the walls.

Out there, in the real world, there’s friction:

- CapEx required for “supporting” tools and infrastructure no one included in the deck

- OpEx costs for connectivity, calibration, data storage

- Operational changes that affect labor, routines, even insurance

- Edge cases that throw off the whole flow

And none of that gets priced into the promise. Which is why growers adopt slower than forecasted, savings don’t match projections, and “value created” doesn’t show up on the P&L. Not because the tech failed. But because the model didn’t match the ground truth.

What’s Worked? (It’s All About Action)

Precision irrigation is a great example of a technology that is creating net-value in Ag. They’re in the action phase. Their systems actually change the physical delivery of water to specific zones, quadrants, or blocks. That’s the real world infrastructure and value. They are increasingly creeping in the analysis phase, taking in things like weather data and cost of electricity and adjusting irrigation schedules in real time. Not just smarter pipes, but responsive ones. Value created through physical action – water flowing differently, money saved on the bill – enhanced by better analysis coming in upstream.

GUSS sprayers are another great example (although we could do without the diesel engine). They targeted a specific job - spraying -and made it better. Not theoretically. They built a machine that does the spraying more efficiently, more safely, and with fewer people. Not the data. Not the analysis. The Action. That’s what brought the JV with John Deere.

Blue River Technologies is a standout exit in Agtech because it didn’t stop at data collection - it closed the loop. Their “See & Spray” system used computer vision to observe, analysis to identify individual plants in real time, and action to precisely target herbicide application. That’s why John Deere paid attention - and paid $305M. This technology operated in all 3 phases, with observation, analysis, and action all happening onboard and in real time. Other advanced weeders like Carbon Robotics fill a similar profile and have seen success, including backing of more than $157 million.

What's Next?

Software moats are shrinking. AI has leveled the playing field. Building and deploying applications has never been easier – or faster. Which means the types of defensibility that used to drive software venture-scale returns is eroding quickly. The next wave of meaningful returns – the Tesla-level, SpaceX-level returns – aren’t going to come from web apps. They’re going to come from hardware and software working together in the form of real, physical tools solving massive problems in the real world.

And agriculture is exactly that. It’s not niche – It’s foundational. Every person participates in it. Every country depends on it. Every climate challenge is intertwined with it. It’s a high-volume, long-tail sector that touches everything – from food to water to emissions to land use. And it’s full of constraints. Natural systems. Labor limitations. Resource volatility. These are hard problems, which is exactly why it’s where the opportunity lies.